vermont income tax rate 2020

Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021. Vermont School District Codes.

Vermont Income Tax Calculator Smartasset

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020.

. PA-1 Special Power of Attorney. 2020 Vermont Tax Rate Schedules Example. IN-111 Vermont Income Tax Return.

Vermont Tax Brackets for Tax Year 2020. Your free and reliable 2020 Vermont payroll and historical tax resource. Meanwhile total state and local sales taxes.

2020 VT Tax Tables. TaxTables-2020pdf 27684 KB File Format. 34 rows Vermont Credit for Income Tax Paid to Other State or Canadian Province.

Detailed Vermont state income tax rates and brackets are available on this page. Find your income exemptions. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017.

Pay Estimated Income Tax by Voucher. Filing Status is Married Filing Jointly. Vermont also has a 600 percent to 85 percent corporate income tax rate.

Pay Estimated Income Tax Online. PA-1 Special Power of Attorney. 2022 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Pay Estimated Income Tax by Voucher. Pay Estimated Income Tax by Voucher. Find your pretax deductions including 401K flexible account.

Vermont State Personal Income Tax Rates and. As you can see your Vermont income is taxed at different rates within the given tax brackets. Vermonts income tax brackets were last changed two.

Tax Bracket Tax Rate. W-4VT Employees Withholding Allowance Certificate. Section 1326 of the Vermont Unemployment.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. W-4VT Employees Withholding Allowance Certificate. Vermonts tax brackets are indexed for.

This column also applies to qualifying widower and civil union filing jointly status This column also applies to civil union filing separately status. Now that were done with federal payroll taxes lets look at Vermont state income taxes. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married.

How to Calculate 2020 Vermont State Income Tax by Using State Income Tax Table. The appropriate schedule is determined by a special formula in the Vermont Unemployment Compensation Law. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent.

Vermont State Payroll Taxes. Vermont new heavy and civil engineering. Tax Year 2020 Personal Income Tax - VT Rate Schedules.

Pay Estimated Income Tax Online. PA-1 Special Power of Attorney. Your free and reliable 2020 Vermont payroll and historical tax resource.

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. 2020 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. VT Taxable Income is 82000 Form IN-111 Line 7.

Any income over 204000 and 248350 for. RateSched-2020pdf 11722 KB File Format. Individuals Personal Income Tax.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Then your VT Tax is. Vermont Tax Adjustments and Nonrefundable Credits.

Base Tax is of 3220. Vermont Income Tax Return. IN-111 Vermont Income Tax Return.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. Vermont charges a progressive income tax broken down.

Vermont Income Tax Brackets 2020

How Bad Are The State Controlled Metropolitan Transportation Authority S Finances Last Week Metropolitan Transportation Authority Borrow Money The Borrowers

Vermont Income Tax Calculator Smartasset

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

936 Brandon Mountain Rd Rochester Vt 05767 5 Beds 4 Baths Fenced In Yard Picturesque Farm

Vermont Income Tax Calculator Smartasset

What Is The Most Valuable Fruit Crop Produced In The Peach State This Is Not A Trick Question But You May Want To Pause A Second Be Georgia Orange Fruit Peach

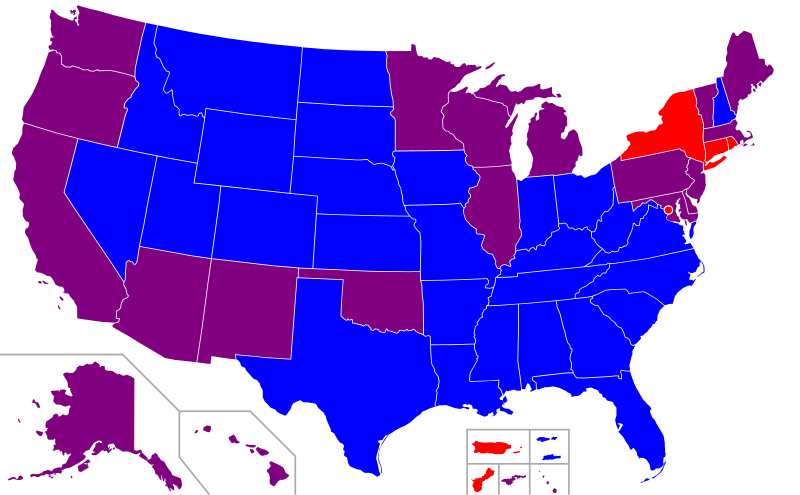

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

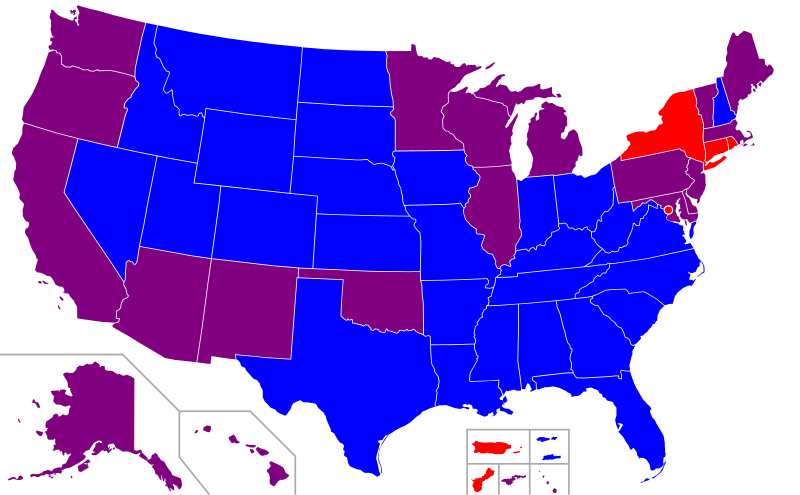

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Tax Burden By State 2022 State And Local Taxes Tax Foundation

The Carlson Law Firm Carlsonlawfirm Twitter Monsanto Law Firm Influential People

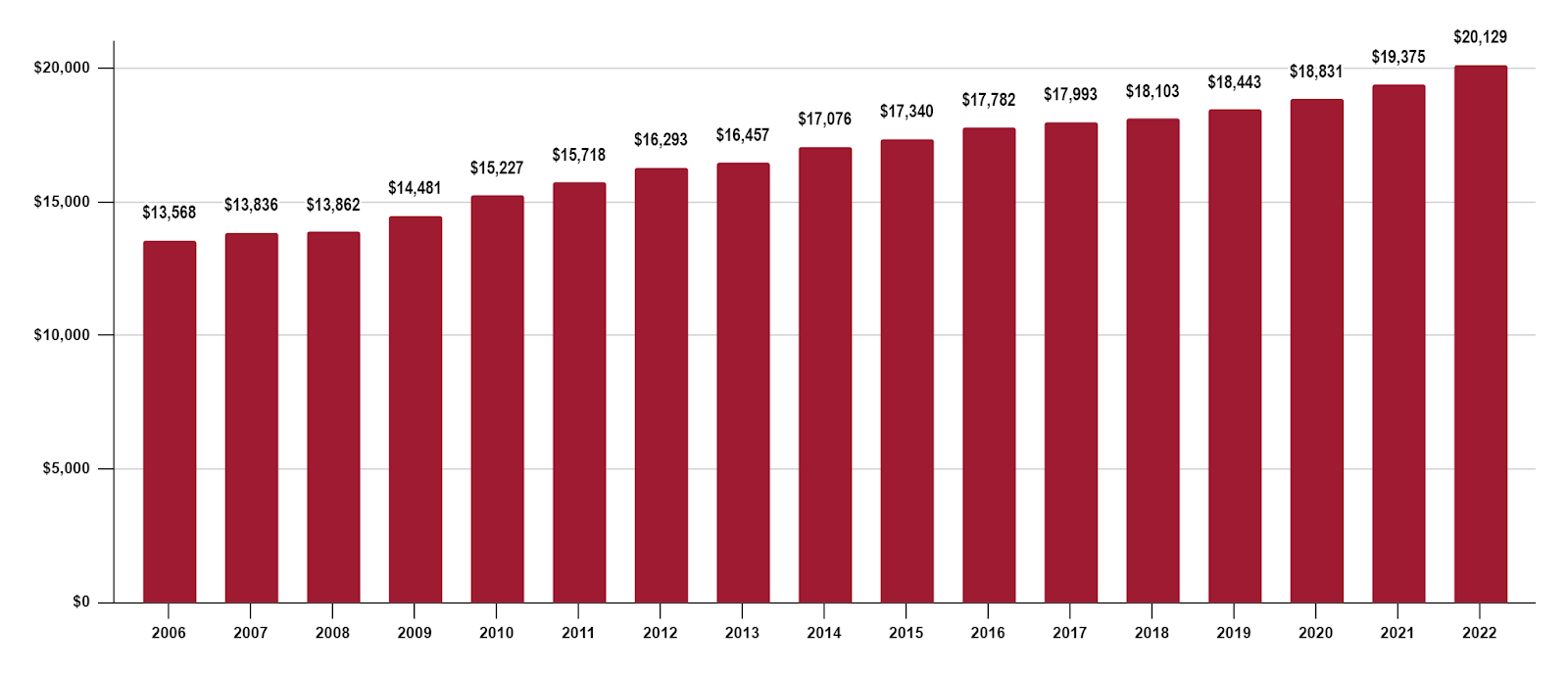

Cigarette Taxes In The United States Wikipedia

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

United States Population Density Kids Encyclopedia Children S Homework Help Kids Online Dictionary The Unit Map Rural Landscape