td ameritrade tax rate

TD Ameritrade receives a. Paying the Least Amount of Taxes Over Your Lifetime.

Fillable Online Standard Retail Pricing Commissions Rates And Fees Td Ameritrade Fax Email Print Pdffiller

Although the number of marginal tax rates stayed the same after the tax reform bill passed the rates were different.

. The marginal tax rates in 2017 before the tax reform were. These are just a. We suggest you consult with a tax-planning professional with regard to your personal circumstances.

So well be going back to 10 in 2026. TD Ameritrade does not provide tax advice. CD Buy orders are subject to a 2 CD 2000 par value minimum.

The statutory rate is 30 unless. That is withheld by TD Ameritrade Singapore and sent to the US. TD Ameritrade Holding Tax Rate as of today June 27 2022 is 2444.

Up to age 50. Tax Rate - Ticker Tape. 6000 into a separate IRA Earnings.

My bank also charged. TD Ameritrade was evaluated. Enter the yield to maturity or yield to call of the municipal bond.

TD Ameritrade does not allow the selling of a CD you do not own in your account short selling. Free from federal income tax when. Hi I live abroad and I recently wire transfered 1000 from an international bank account to my TD ameritrade account.

010 of the total transaction cost of in scope equities and other financial instruments and a flat amount which ranges from EUR0 025 to EUR 200 depending on the relevant instruments and. Futures Options on Futures. Rmd amounts depend on various factors such as the beneficiarys age.

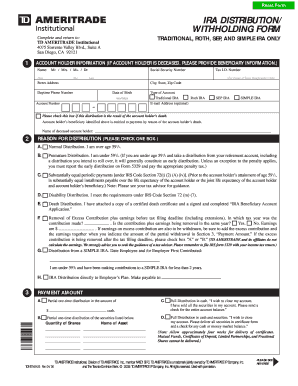

How much do you get taxed on TD Ameritrade. However I only received 978 in my actual balance. Is required by federal andor state statutes to withhold a percentage.

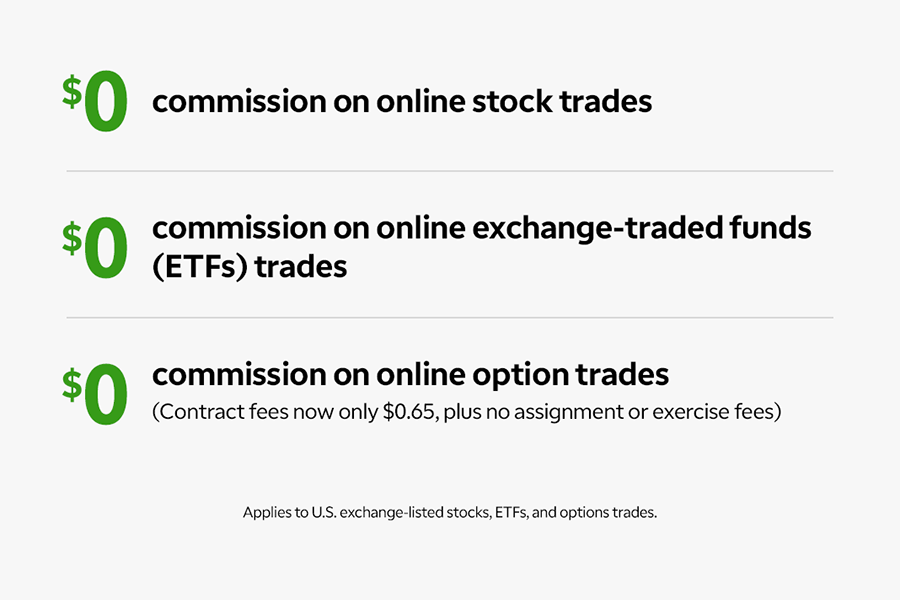

Ad Compare Your 2022 Tax Bracket vs. But if you prefer your statements the old fashion way TD Ameritrade will charge you a 2 fee for each mailing if your account value is less than 10000. 225 fee per contract plus exchange regulatory fees Youll have easy access to a variety of available investments when you trade futures with a TD.

Internal Revenue Service IRS on your behalf so no additional tax is due after the year ends. 225 fee per contract plus exchange regulatory fees Youll have easy. If your security position is made up of several tax lots and they consist of both long- and short-term holdings highest.

Td Ameritrade Tax Calculator. - The Roth IRA. The TCJA reduces that from 10 to the current percentage of 75.

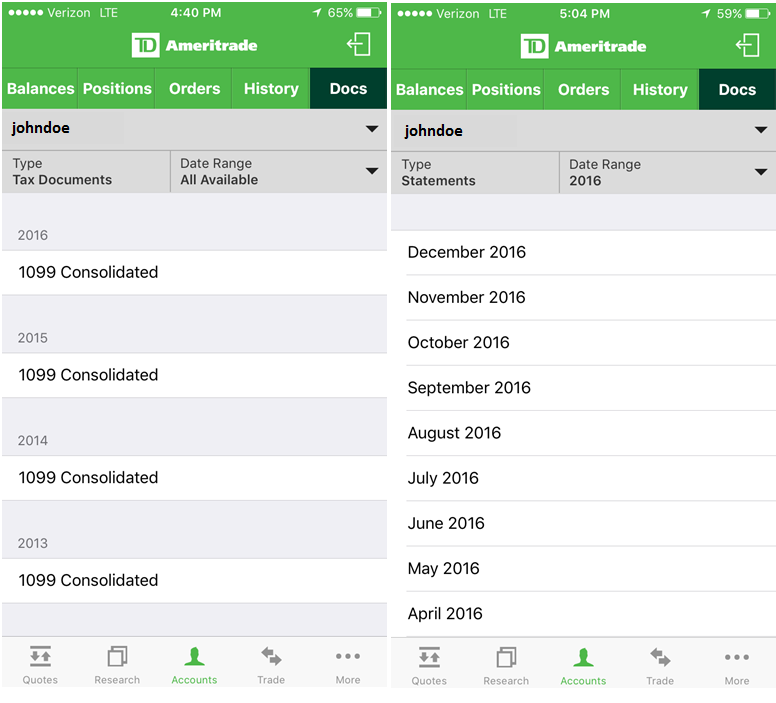

Highest cost does not consider the length of time you held your shares. Check out our tax resource center for tools and tax calculators to help you prepare your taxes this year and evaluate potential tax implications. Td ameritrades tax information guide helps simplify the process so that tax season can be a little less taxing.

As of 2020 the tax rates for long-term gains rates range from zero to 20 for long-term held assets depending on your taxable. Larger accounts are not subject to this.

Td Ameritrade Essential Portfolios Review Smartasset Com

Td Ameritrade Review 2022 Day Trading With 0 Commissions

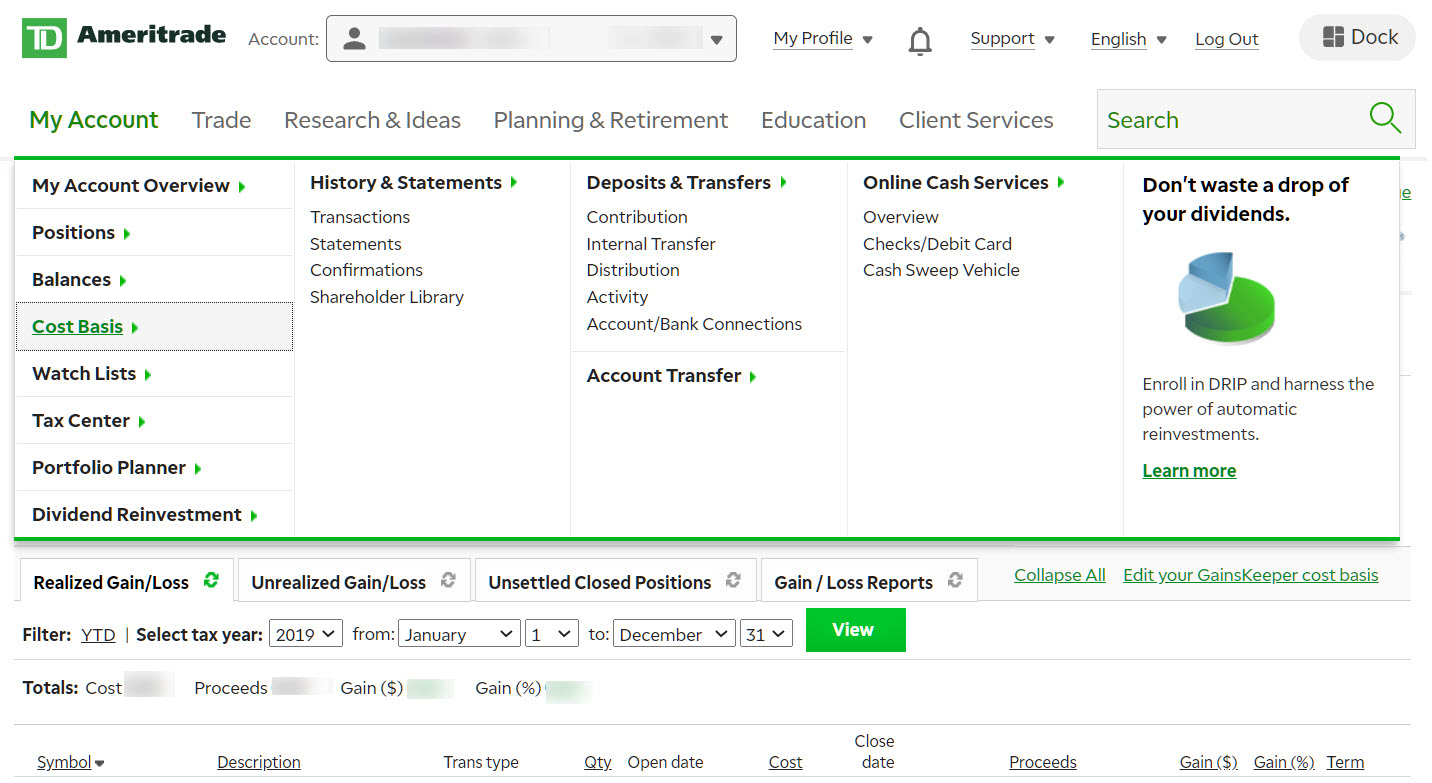

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

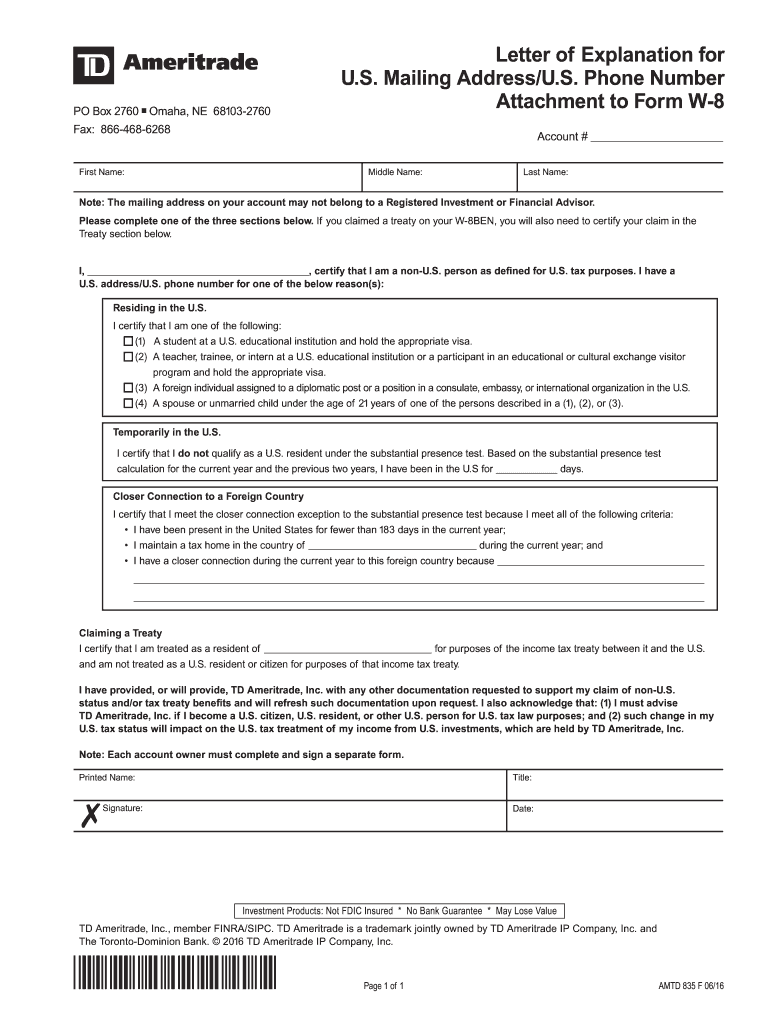

W8ben Td Ameritrade Fill Online Printable Fillable Blank Pdffiller

How Do Tax Brackets Actually Work Youtube

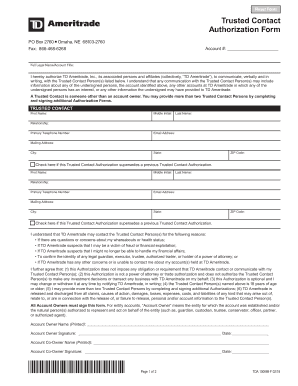

Td Ameritrade Forms Fill Out And Sign Printable Pdf Template Signnow

Choose The Right Default Cost Basis Method Novel Investor

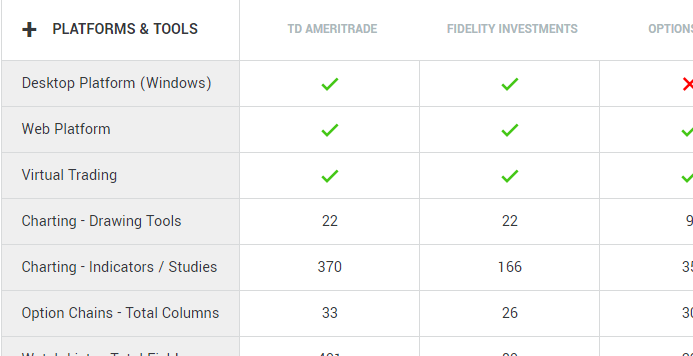

Td Ameritrade Review Is Td Ameritrade Good For Beginners

Td Ameritrade Broker Review 2021 Warrior Trading

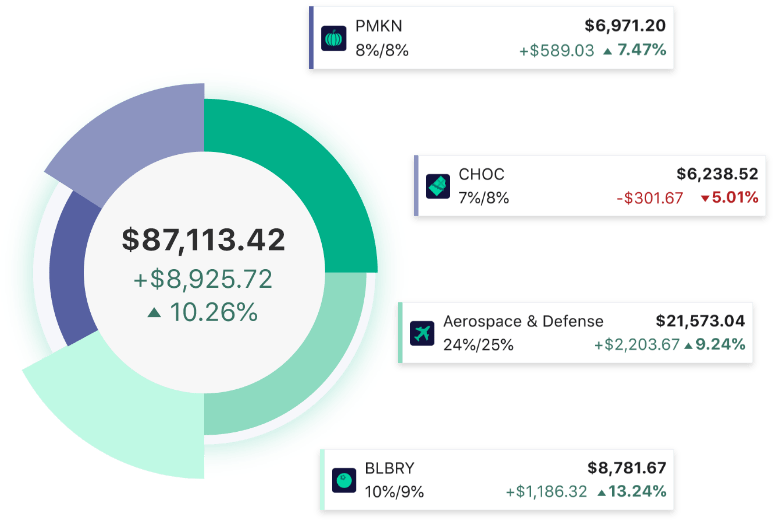

M1 Vs Td Ameritrade Build Your Wealth Your Way

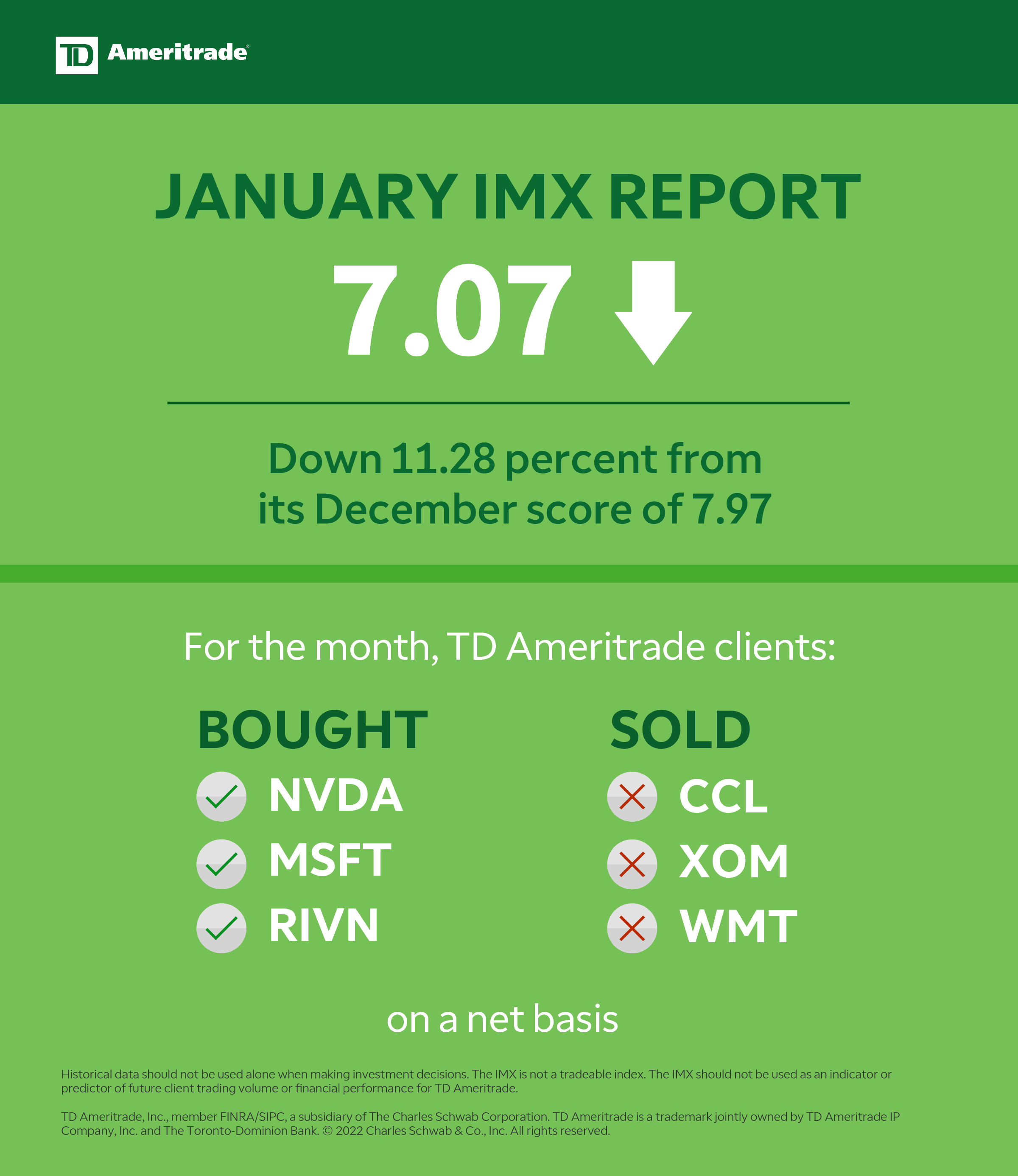

Td Ameritrade Investor Movement Index Imx Score Hits One Year Low In January Business Wire

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

Free Stock Trading Td Ameritrade

2020 Tax Brackets And Tax Deductions Silver Linings Ticker Tape

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

Td Ameritrade Review 2022 Find All Features Pros Cons